How to Keep Receipts Organized in 2026: A Practical Guide for Small Businesses

Jan 11, 2026

Receipts have a way of multiplying.

They show up as paper slips, PDFs in email, photos on phones, and forwarded messages in WhatsApp. Most small businesses tell themselves they’ll “sort it out later”—usually at tax time.

In 2026, that approach creates unnecessary stress.

Knowing how to keep receipts organized is no longer about having a perfect system. It’s about building a few simple habits that work with how small businesses already operate—so receipts stay under control all year long.

This guide breaks it down, step by step.

Why It’s Important to Keep Receipts Organized

For small businesses, receipts are more than proof of purchase. They’re the backbone of:

Tax preparation – expenses need documentation

Compliance – being ready when questions come up

Expense tracking – understanding where money actually goes

Peace of mind – no last-minute document hunts

When receipts aren’t organized, problems show up late—often when there’s no time to fix them calmly.

Good organization prevents those moments before they happen.

How Receipt Organization Has Changed by 2026

Receipt organization today looks very different from even a few years ago.

Three big shifts define 2026:

Digital-first receipts

Most receipts now arrive digitally—email, apps, PDFs—sometimes without any paper involved.

Mobile capture

Phones are the primary capture device. Waiting to scan later usually means forgetting entirely.

OCR and automation

Receipts aren’t just stored as images. Key details (date, vendor, amount) can be extracted automatically.

The result: organization happens continuously, not once a year.

Core Principles for Keeping Receipts Organized

Instead of thinking in terms of tools, focus on principles. These work no matter what system you use.

1. One place beats many folders

Choose a single place where all receipts live. Multiple folders or inboxes create confusion and missed documents.

2. Capture early

The sooner a receipt is captured, the less likely it is to disappear.

3. Don’t rely on memory

If you’re telling yourself “I’ll remember what this was for,” you won’t.

4. Make retrieval easy

Organization isn’t about storage—it’s about finding what you need in seconds.

These principles are the foundation of any effective receipt system.

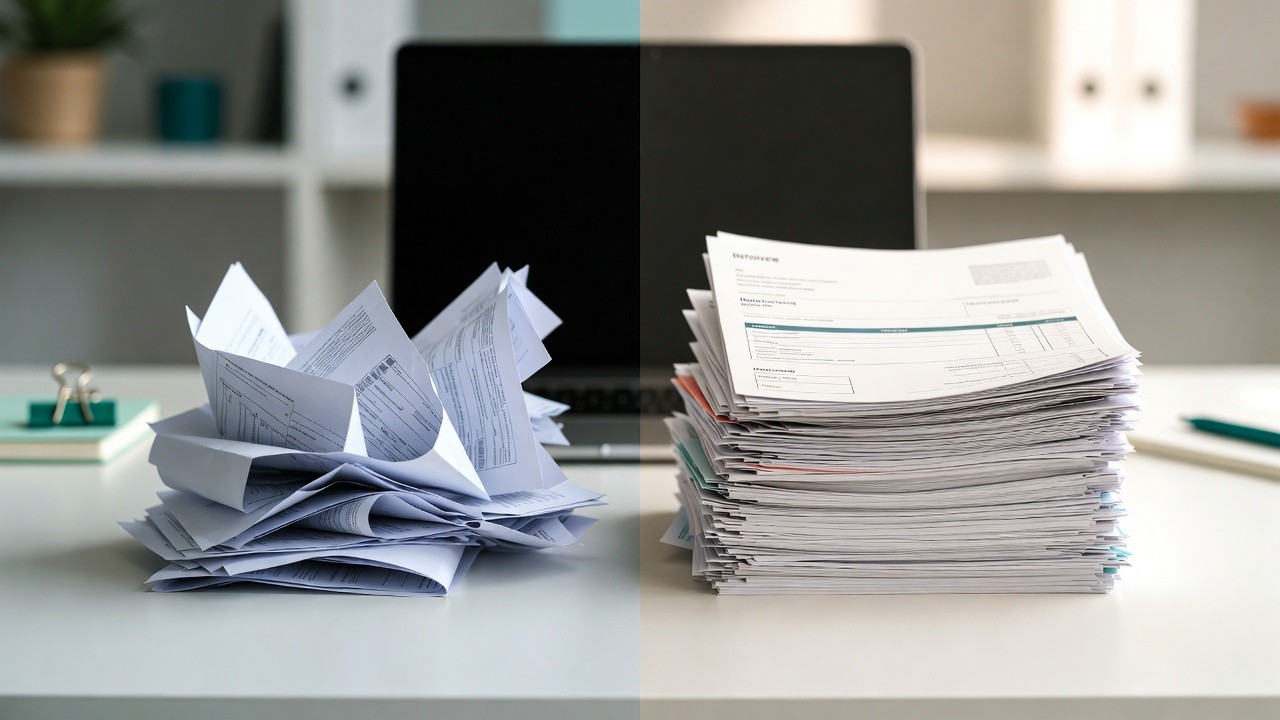

Digital vs. Physical Receipt Organization: What Actually Works

Many small businesses ask whether it’s better to keep receipts digitally or physically. The honest answer: digital works best for most SMBs, with minimal physical backup.

Digital receipts – the default choice

Digital organization makes it easier to:

Search by date, vendor, or amount

Share records with accountants

Avoid faded or lost paper

Prepare for taxes without panic

Physical receipts – when they still matter

Paper receipts can still be relevant when:

A vendor only provides paper

Local regulations require originals (less common)

In practice, most businesses scan paper receipts and keep them only temporarily.

The best way to organize receipts for small business in 2026 is digital-first, with simple backups.

A Simple Digital Workflow for Organizing Receipts

You don’t need a complex setup. A simple workflow looks like this:

1. Capture

Receipts are captured as they arrive:

Photo on a phone

Email attachment

PDF upload

Forwarded message

2. Store

All receipts go into one centralized location. No sorting yet—just capture.

3. Extract data

OCR reads the receipt and pulls out key information:

Vendor

Date

Amount

This turns a file into usable data.

4. Categorize

Receipts are grouped by expense type, month, or business category.

5. Review regularly

A quick review keeps everything accurate and complete—no surprises later.

This workflow supports keeping track of business expenses without adding daily admin.

Common Receipt Organization Mistakes to Avoid

Even disciplined businesses fall into the same traps:

Saving receipts without context

Creating too many folders

Waiting until year-end to organize

Mixing personal and business receipts

Relying on bank statements instead of receipts

Avoiding these mistakes is often more impactful than changing software.

How Organized Receipts Make Tax Time Easier

Tax time is where receipt organization pays off the most.

When receipts are organized:

Expenses are already documented

Missing items are obvious early

Accountants don’t need to chase files

Reviews are faster and calmer

Instead of scrambling, tax prep becomes a confirmation process.

That’s the real benefit of organizing receipts for tax time—less stress, fewer questions, and more confidence.

Conclusion: Start Simple and Stick With It

Learning how to keep receipts organized isn’t about finding the “perfect” system. It’s about choosing something simple and sticking with it.

Start early. Capture consistently. Keep everything in one place. Review occasionally.

Tools like DoxBox are designed to support these habits by helping small businesses capture, organize, and extract receipt data automatically—without changing how they already work.

The best receipt system is the one you actually use.

Frequently Asked Questions

How do I organize receipts for small business taxes?

Capture all receipts digitally, keep them in one place, and make sure key details (date, vendor, amount) are easy to find.

Is it better to keep paper or digital receipts?

For most small businesses, digital receipts are easier to store, search, and share. Paper is usually only needed temporarily.

Can I use bank statements instead of receipts?

Bank statements show payments, not what was purchased. Receipts are still required for proper documentation.

What’s the simplest way to store receipts electronically?

A single digital location with automatic capture and basic categorization is usually enough.